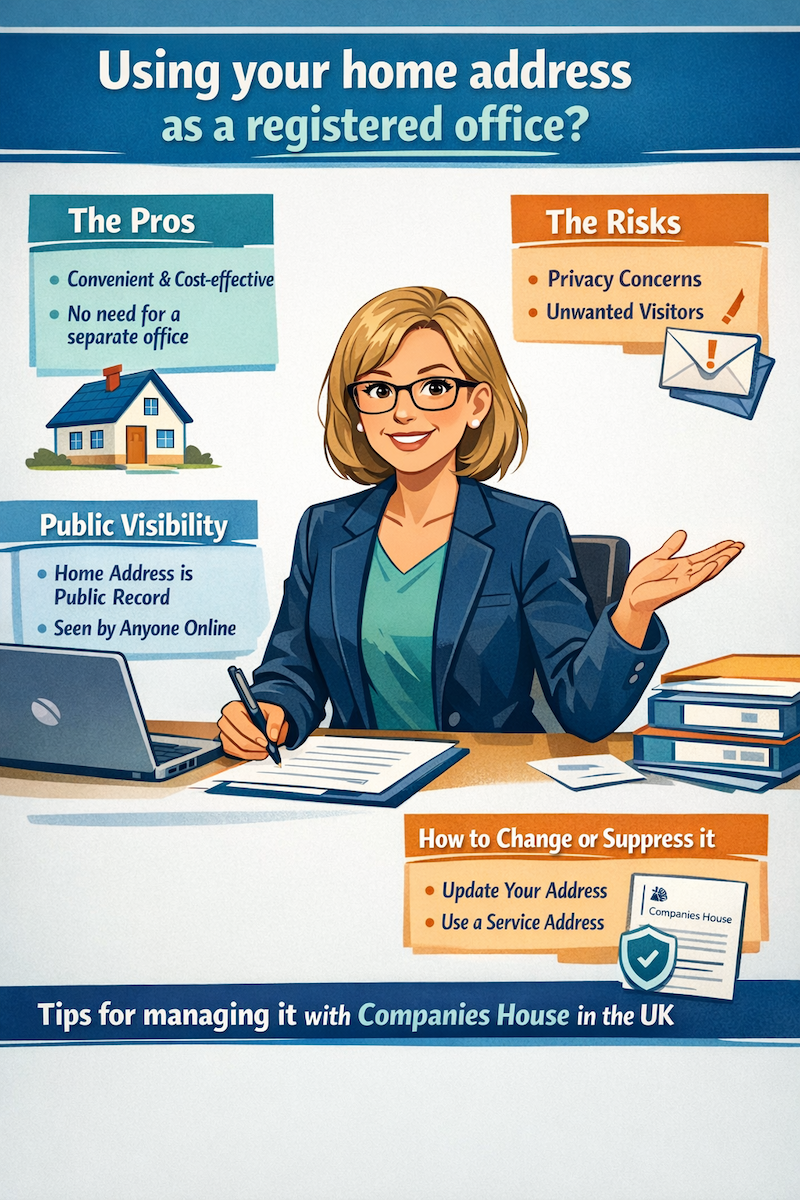

Using your home address as your company’s registered office is common, especially when a limited company is new. It’s legal, simple, and often feels like the obvious default.

But it’s also one of those decisions that quietly follows you around for years if you don’t understand the implications properly.

This blog explains:

- What a registered office actually is

- The pros and cons of using your home address

- The exact steps and forms involved

- How to reduce or remove your home address from public records (where possible)

What is a registered office address?

A registered office is your company’s official legal address.

It’s the address used by:

It must:

- Be a physical UK address

- Be in the same jurisdiction as your company

- Be an address where official post can be reliably received

This is not just admin. This is where legal responsibility lives.

Can you use your home address as a registered office?

Yes. It is completely legal.

Many directors do this when:

- The business is new

- They work from home

- There is no separate office

But “legal” does not mean “neutral”.

The downsides directors usually discover too late

1. Your home address becomes public

Anyone can search your company and see the registered office address. That includes clients, suppliers, marketers, and anyone else with internet access.

2. It becomes part of the company’s filing history

Even if you change the registered office later, older documents may still show your home address.

3. All statutory post goes there

Companies House reminders, HMRC notices, and legal correspondence are all sent to the registered office. Missing a letter does not pause a deadline.

4. It can affect perception

For some businesses, a residential address does not align with the professional image they want to present.

None of this means using your home address is wrong. It means the decision should be intentional.

How to use your home address as a registered office.

New companies

When incorporating, you enter the registered office address during the formation process. No separate form is required.

Once incorporated, the address appears on the public register immediately.

Existing companies

If your company already exists and you want to change the registered office to your home address, you must file:

- Form AD01 – Change of registered office address

This:

- Is free

- Can be filed online

- Takes effect only once registered by Companies House

This change applies from that point onward only.

Updating HMRC

Changing your registered office with Companies House does not automatically update HMRC.

You must separately update:

- Corporation Tax correspondence address

- PAYE address (if applicable)

- VAT correspondence address (if VAT registered)

If HMRC sends post to an old address, penalties still apply even if you never received the letter.

Can you remove your home address from the Companies House register?

This is where advice often goes wrong.

If your home address is the current registered office

You cannot remove it from the public register.

A registered office address must always be visible. If it is residential, it remains visible while it is in use.

If your home address was previously used as a registered office

Historically, this address could not be removed from historical documents.

However, under new measures introduced by the Economic Crime and Corporate Transparency Act 2023, individuals can now apply to have a residential address suppressed from certain historical documents, even where it appeared as a registered office address, in most instances.

Important limitations:

- Suppression is not automatic

- Applications are document-specific

- Not all documents will qualify

- Some historical visibility may still remain

- Evidence may be required in certain cases

This is a suppression, not a guaranteed wipe.

Removing your home address where it appears as a personal detail

Where your home address appears as a personal detail (for example on director or PSC filings), you can apply for removal using:

- Form SR01 – Application to remove personal details from the register

Key points:

- You must list each document separately

- The cost is £30 per document

- Approval is not guaranteed

SR01 does not remove the fact that an address was once a registered office, but it can reduce personal exposure elsewhere.

What actually works in practice

If privacy matters to you:

- Change the registered office to a non-residential address as soon as possible

- Update HMRC separately

- Review historic filings

- Apply for suppression selectively where appropriate

- Assume some historical visibility may remain

Should you use your home address as a registered office?

It can be fine if:

- You’re comfortable with public visibility

- You reliably receive post

- You understand the long-term implications

It’s often not ideal if:

- Privacy matters

- You plan to scale or sell

- You want a clear separation between home and business

Final thought

Your registered office is not just an address. It is a permanent marker in your company’s public history.

You can change it. You can sometimes suppress parts of the past. You cannot assume it will ever disappear completely.

Choose it like someone running a company, not someone filling in a form in a rush.

If you would like to explore this more please contact us at The Accountancy Office to make an appointment and we will be happy to discuss this with you.